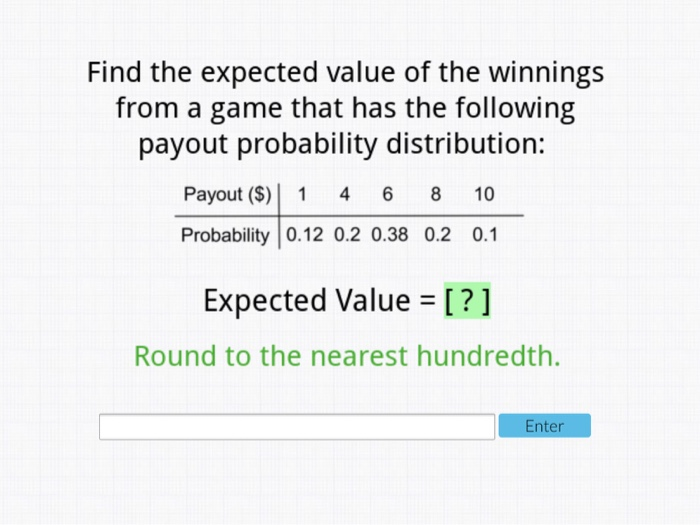

These values can be positive and negative resulting in gain or loss respectively. According to PMBOK, expected monetary value is a product of two numbers, risk probability value and risk event value which is an estimate of loss or gain that will be incurred if the risk event occurs. Įxpected monetary value is another way to quantify risk.

Define the following term risk probability distrituion software#

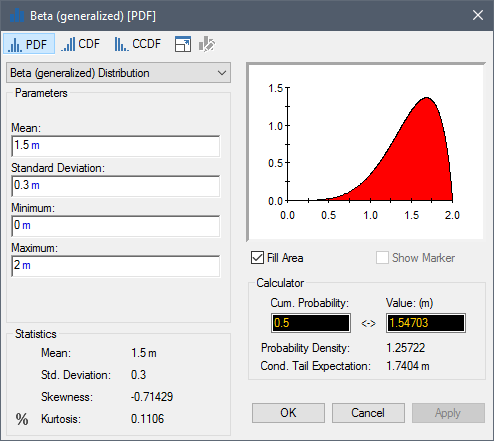

The ratings are estimated ratings, quantified by SEM (Structural Equation Modeling) software based on the sub risks and attributes ratings assigned by experts using 1-5 Likert Scale. Figure 3 shows an example of risk quantification using expert opinion in a case study on construction project conducted by Yildiz et al. Although, expert opinion is not as concrete, as other methods may be, and may prone to personal subjectivity, but it is a very useful tool for risk quantification when data is scarce or no sufficient past experience is available or where risks are very company or project specific. This bias can be minimized by using Delphi method, but there still be a chance of high variation in opinion. But, this may lead to group bias and can affect the outcome. One of the best ways to use expert opinion is to conduct risk assessments workshops where experts can discuss and consequently assign values to the to the risks identified.

In expert opinion, risks are quantified based on the opinions of experts or senior executives based on their experiences. Expert opinion is one of the risk quantification techniques. Merriam Websterdefines expert opinion as, “a belief or judgment about something given by an expert on the subject”. Such as natural disaster or departure of key member etc.Ĭost Estimates: Assessment of likely cost required to complete the project activities.Īctivity Duration Estimate: Quantitative assessment of likely number of work period required to activities of a project Potential Risk Events: Discrete occurrences that can occur during a project that may affect the outcome of the project. Opportunities to Ignore, Threats to Accept: List of opportunities that can be ignored and threats that can be accepted. For example, Designs errors, stakeholder actions, or poor estimates etc.

Sources of Risks: Categories of possible risk events that may negatively affect the outcome of a project. Opportunities to Pursue, Threats to Respond to: The list of opportunities that should be pursued and threats that should be taken care of. Stakeholder Risk Tolerance: Every organization and different individuals may have different tolerance for risk value Table 1: Inputs and Outputs to Risk Quantification in Project Management According to PMBOK, following inputs are considered and outputs are produced in risk quantification process of any project: In risk quantification process of a project, there are inputs that should be considered with delegate care and as a result of risk quantification process outputs are generated. Inputs and Outputs of Risk Quantification PMBOK describes risk quantification as evaluating risks and risk interactions to assess the range of possible outcomes. Risk quantification is a process of evaluating the risks that have been identified and developing the data that will be needed for making decisions as to what should be done about them.

0 kommentar(er)

0 kommentar(er)